Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: TECH RECHARGES AS LIQUIDITY OUTLOOK IMPROVES

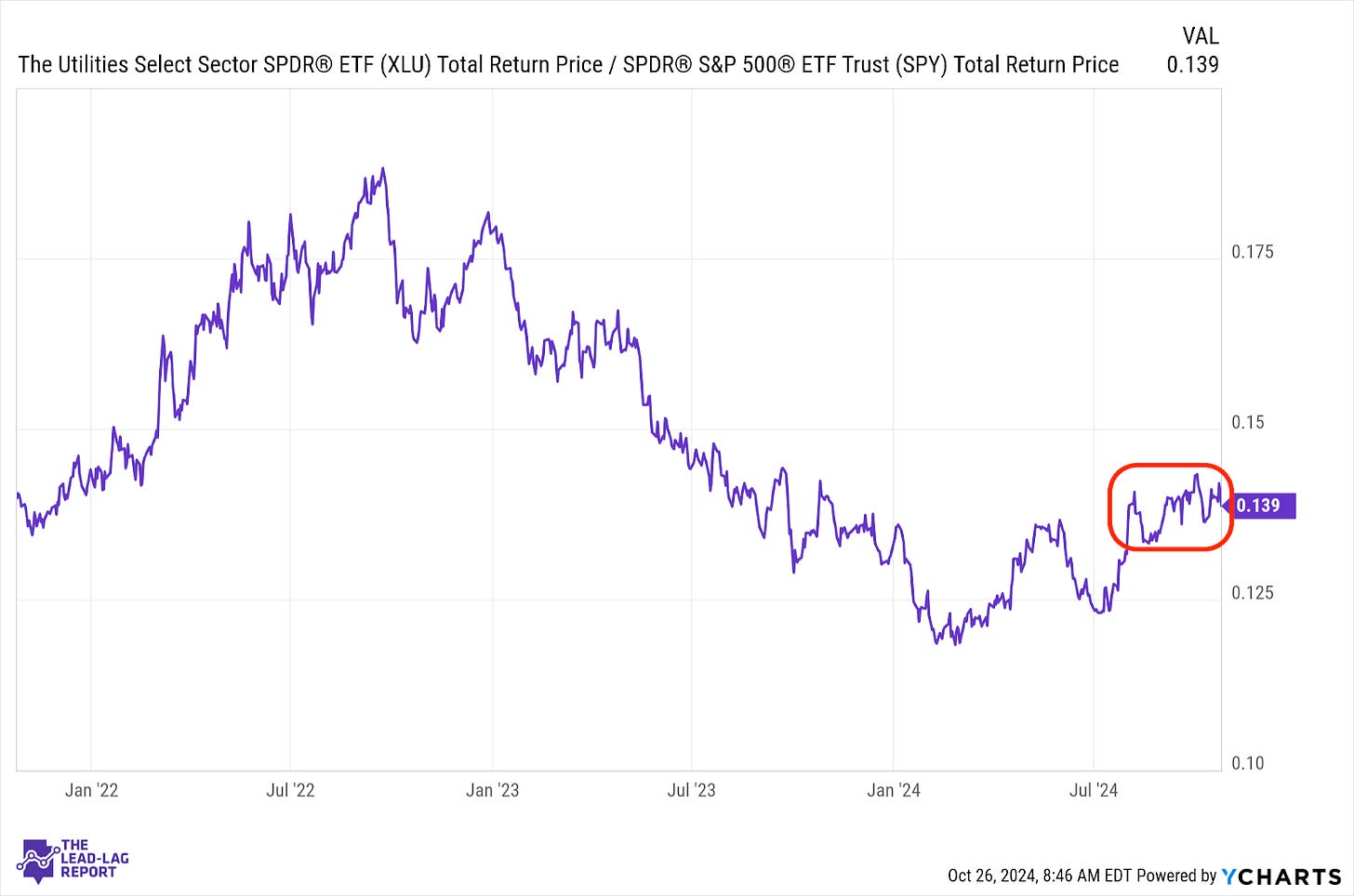

Utilities (XLU) – What’s Causing This Sector To Swim Against The Current?

Utilities are doing a lot of bouncing around relative to the S&P 500, but the fact that they’re not underperforming in the way that its defensive counterparts, staples and healthcare, are is noteworthy. This sector along with gold have pretty consistently been signaling caution despite the big gains in U.S. stocks this year. That’s usually not a mistake, but we have yet to see which risk is really driving these rallies.

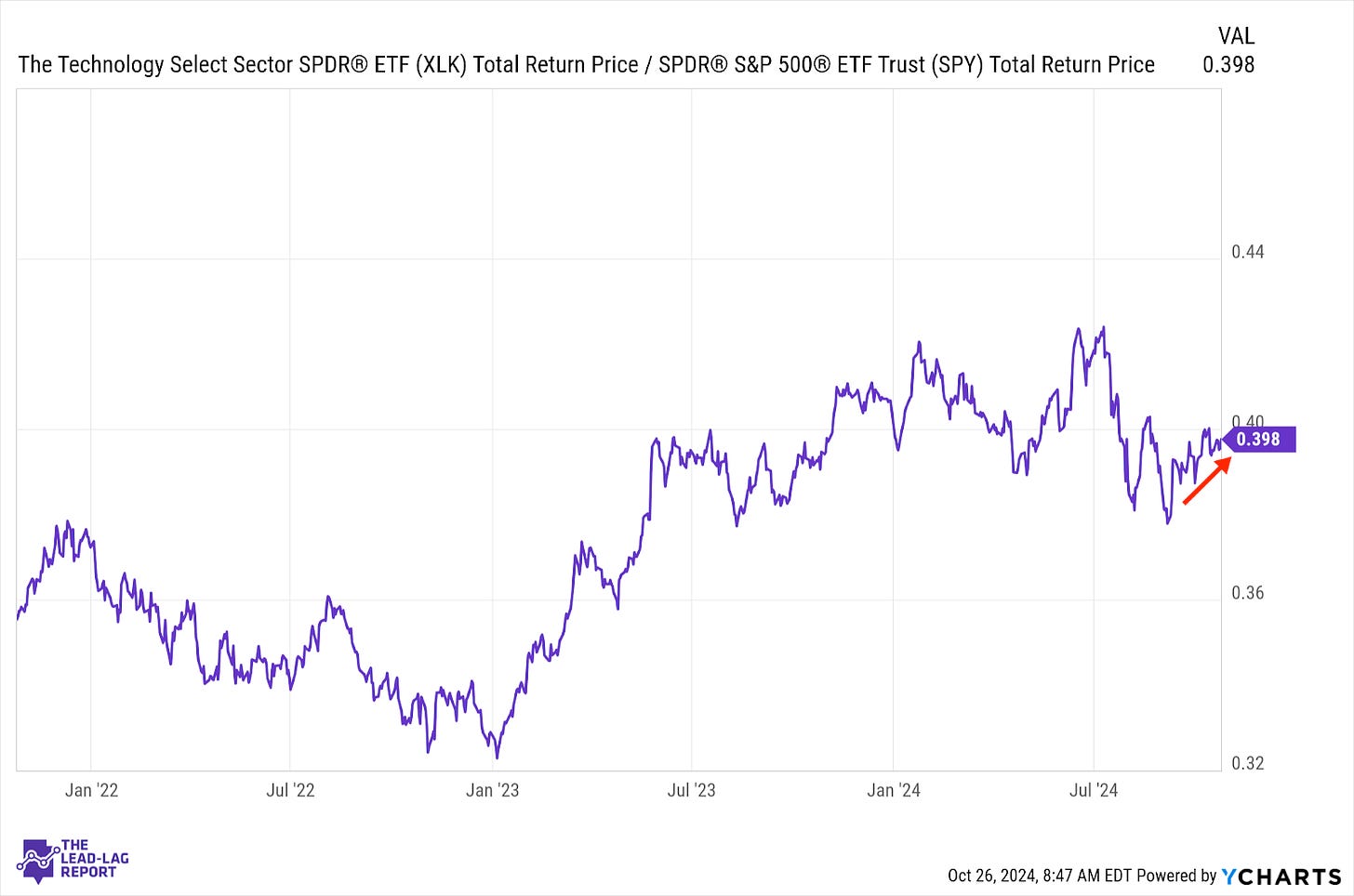

Technology (XLK) – Big Earnings Week Ahead

Tech has finally been building some momentum again as the market continues to move higher, but broadens out beyond just cyclicals. The sector will get a big test this week when a number of mega-cap names, including five from the magnificent 7, report quarterly earnings. On that front, growth rates are likely to slow, but their comparatively strong financial performance coupled with the ongoing optimism surrounding the AI boom could yield positive results again.

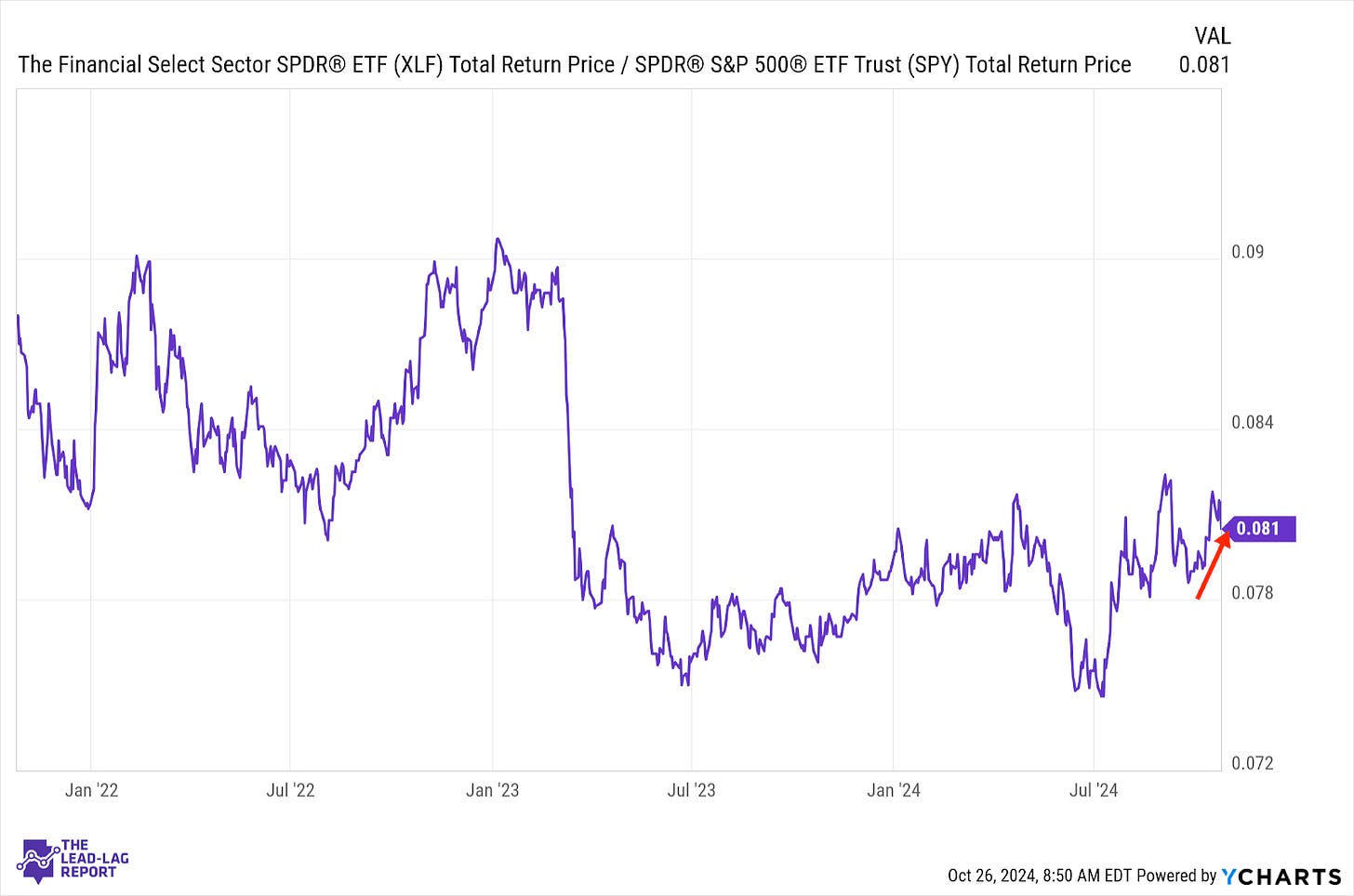

Financials (XLF) – Big Banks Looking Good; Regional Banks Less So

Conditions for the big banks seem to be improving based on what we saw from Q3 earnings. The regional banks are in a little tougher position since they generally don’t have the investment banking or trading income to rely on. As long as economic growth rates look positive, banks could benefit from higher rates on new lending, but that could quickly be outweighed if conditions start to reverse.

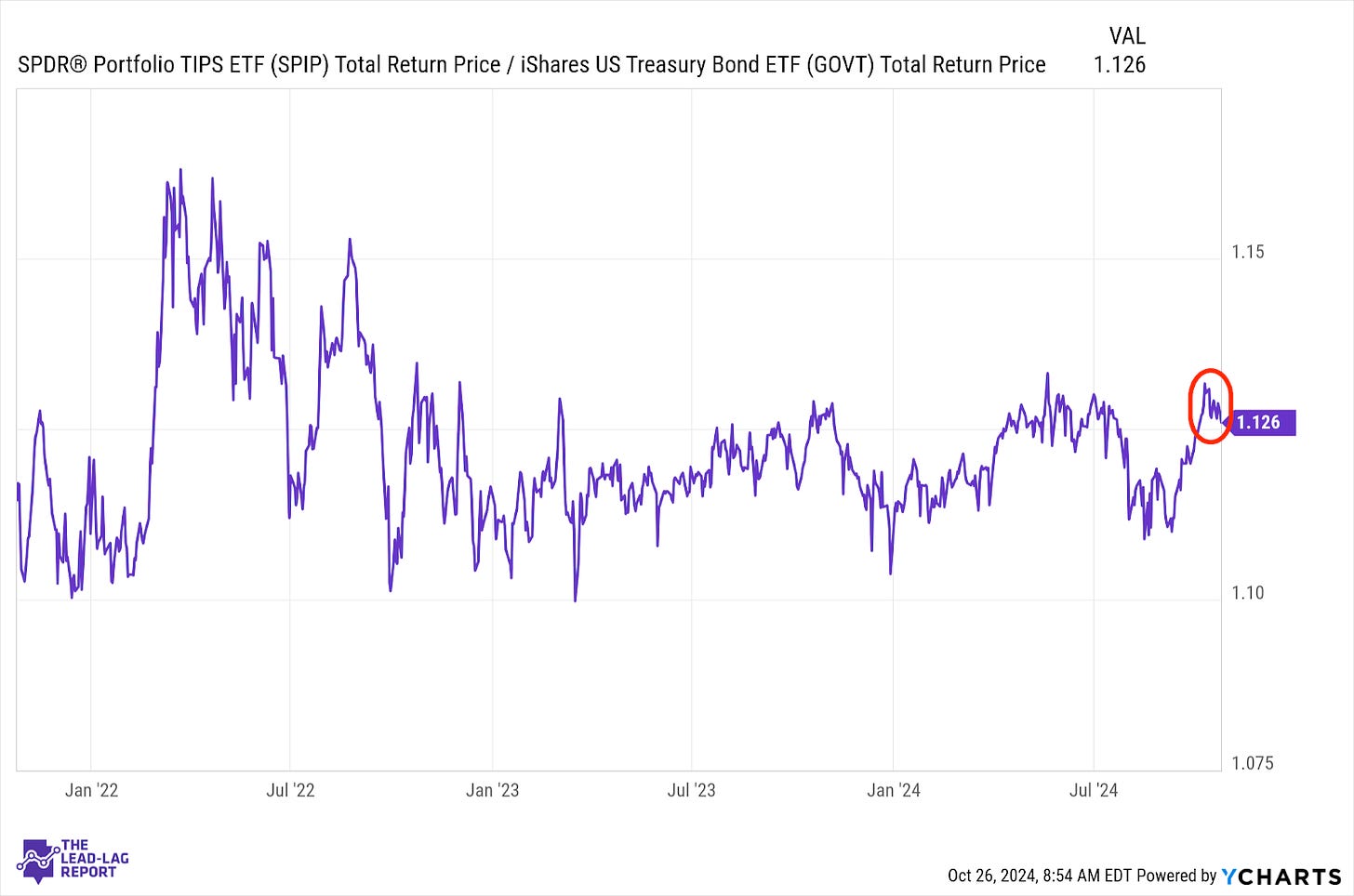

Treasury Inflation Protected Securities (SPIP) – Uptrend Isn’t Over

Inflation protection is taking a bit of a pause after a strong multi-week rally relative to Treasuries. Given the combination of factors working in their favor right now - continued growth, resilient retail sales, rate cuts and more liquidity - I wouldn’t bet on this recent rally being over. Sticky core, rent and services inflation suggest that TIPS should see steady demand for a while longer.

Junk Debt (JNK) – Weak Foundation

Keep reading with a 7-day free trial

Subscribe to The Lead-Lag Report to keep reading this post and get 7 days of free access to the full post archives.