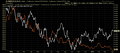

April 7, 2023 - Lumber/Gold Ratio Is Indicating That Near-Term Correction Could Be 10-15%

This is a tough time for investors. A lot of people have probably opened their quarterly statement, seen a 7% return on the S&P 500 in Q1 and think that the good times are back. After all, unemployment is still incredibly low. GDP growth is positive. And it’s a pre-election year, which historically has been good for risk assets.

I think investors might be getting

rope-a-doped here. I’m looking at the intermarket signals and I see an anomaly brewing that could hit investors hard and maybe soon. Lumber/gold is the key and I’m going to explain why.

As I say often, lumber is a tell on the housing market. Housing is a tell on the economy. Gold is considered in many circles to be a safe haven (although in reality it’s more of an uncorrelated asset than anything. It’s just a good old fashioned measure of an economically-sensitive asset versus an economically-defensive asset. The lumber/gold ratio has a long history of turning either higher or lower in advance of a similar move in risk assets. I think it’s giving us that very signal right now.

Keep reading with a 7-day free trial

Subscribe to The Lead-Lag Report to keep reading this post and get 7 days of free access to the full post archives.