Below is an assessment of the performance of some of the most important sectors and asset classes relative to each other with an interpretation of what underlying market dynamics may be signaling about the future direction of risk-taking by investors. The below charts are all price ratios which show the underlying trend of the numerator relative to the denominator. A rising price ratio means the numerator is outperforming (up more/down less) the denominator. A falling price ratio means underperformance.

LEADERS: THE FED IS BRINGING LUMBER BACK TO LIFE

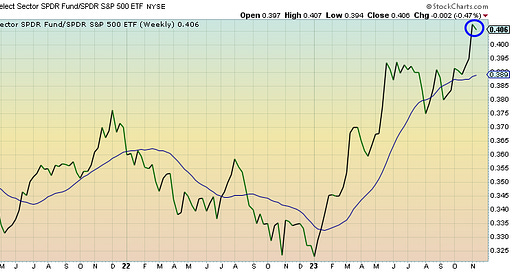

Technology (XLK) – Different This Time Around

Tech’s underperformance last week was notable because it wasn’t what happened during the everything rally a few weeks ago. This time around, it was value stocks that led the way, so perhaps there’s a bit of a different composition to this move. At a high level, expensive stocks, such as tech, should begin lagging as high rates cause valuations to contract. We haven’t seen it yet, but with a lot of the good news now in the rear view mirror, there’s a chance that sentiment starts to shift.

Consumer Discretionary (XLY) – Is The Consumer Still Hanging On?

A lot of the latest estimates and indications from retailers suggest a softer than usual holiday shopping season. That’s not prevented this sector from outperforming recently, but the overall outlook is still questionable with the consumer looking tapped out. October retail sales were down month-over-month, but still beat expectations, so it’s possible the consumer is able to hang on for longer.

Communication Services (XLC) – Weaker Than It Looks

This sector continues shifting from market-beating to market-matching. Overall, it’s recovered about half of its underperformance since the latter half of 2021, but that’s mostly due to the leadership of Facebook and Alphabet. Elsewhere, the sector is still looking much weaker and has likely been lifted by the broader growth rally this year. This group could get hit harder than most if the FAAMG trade really turns.

Financials (XLF) – Landmines Everywhere

Bank stocks are getting a slight reprieve from lower interest rates taking some pressure off of margins, but the fall of Citizens Bank demonstrates pretty clearly that there are landmines all over the place here. Whether it’s commercial real estate loans, trucking loans or even simple credit card debt, banks will keep finding their credit portfolios deteriorating in quality throughout most, if not all, of 2024.

Long Bonds (VLGSX) – Not The Flight To Safety Trade Just Yet

Keep reading with a 7-day free trial

Subscribe to The Lead-Lag Report to keep reading this post and get 7 days of free access to the full post archives.