Gold, Utilities & Treasuries Are Experiencing Sharp & Sudden Rallies At The Same Time

What Does It Mean For Forward Returns?

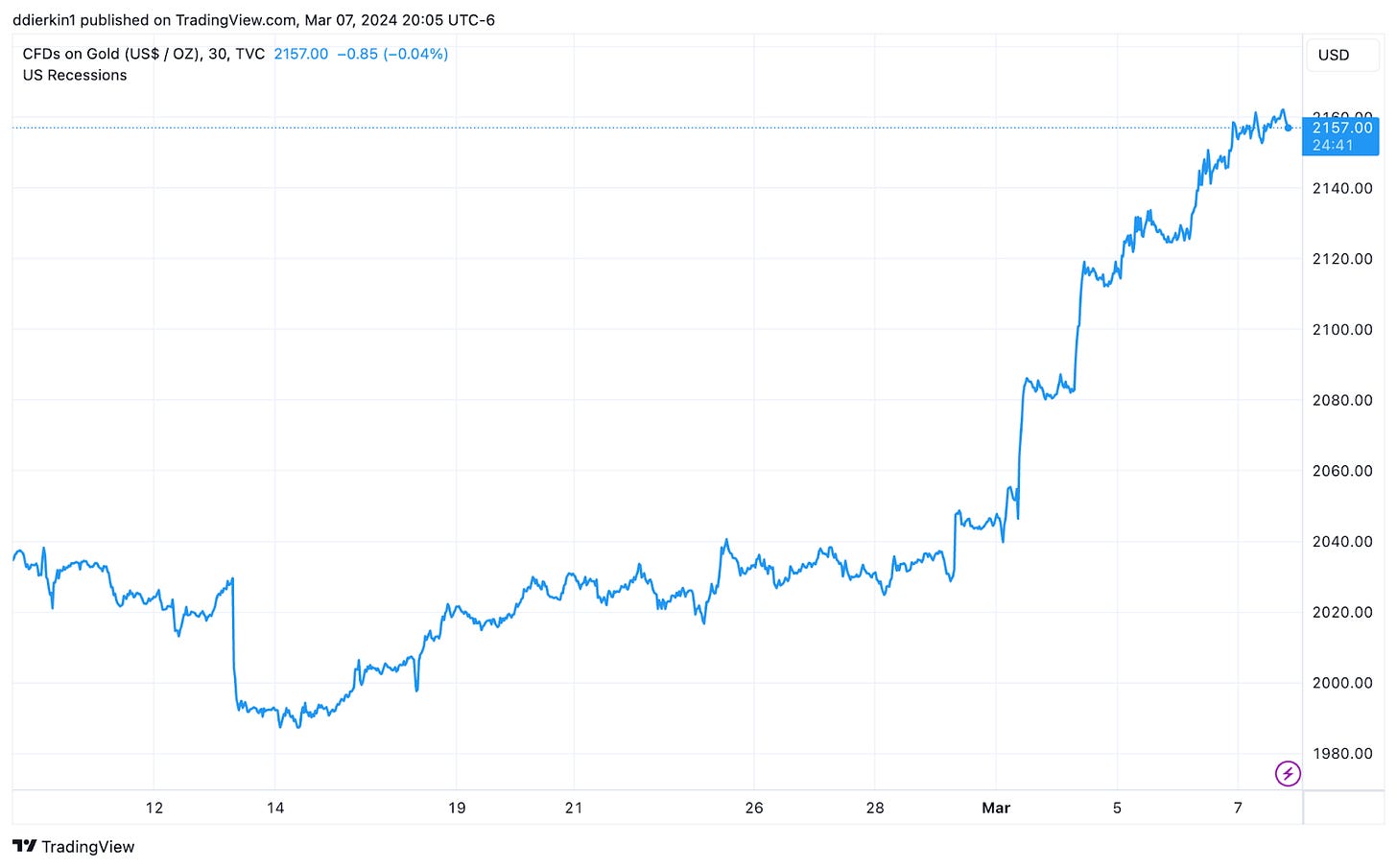

In case you haven’t looked at the chart of gold prices lately, let me throw this up for you.

Gold prices have been absolutely ripping during the month of March, currently up more than $100 per ounce since the start of the month and setting new all-time highs on almost a daily basis.

We all know the familiar investing principle that gold is a traditionally defensive asset class that prospers when there’s trouble elsewhere in the financial markets. As to what that reason could be at this moment requires a bit of guessing because there are a number of potential candidates.

A steady drop in long-term interest rates fueled by the belief that the Fed will cut rates soon.

A pickup in inflation.

A reversal in the yen carry trade that’s negatively impacting the dollar.

The more important thing, in my opinion, isn’t why it’s happening, but what else is happening alongside it.

As gold is rallying, so are utilities and long-term Treasuries. This trifecta of risk-off assets all performing strongly at the same time could be providing a very serious warning for investors.

I dove into the numbers and noticed a couple of milestones that were achieved recently. As of right now, gold has risen more than 6% over the prior 7 trading days. Earlier this week, we hit the mark where gold was up 5% while utilities were simultaneously up 4% over the prior 7 trading day period.

With this kind of short-term shock in defensive assets, I wanted to see if history had any kind of guidance as to what future returns might look like in this type of scenario. The exercise would be simple. When these triggers have been hit in the past, look at forward returns for five different asset classes - gold, long-term Treasuries, utilities, large-caps and small-caps. The ultimate question we’re trying to answer is whether risk-off shocks lead to further risk-off behavior.

Keep reading with a 7-day free trial

Subscribe to The Lead-Lag Report to keep reading this post and get 7 days of free access to the full post archives.