While the markets generally remain in a risk-on mood for now, which is currently being confirmed by all four risk signals, there are some disconnects getting built up in a couple of asset classes. It’s understandable that utilities and long-term Treasuries would underperform in this kind of environment, but the degree of underperformance looks egregious and out of synch for what seems reasonable given current conditions. Not only are utilities the worst-performing S&P 500 sector year-to-date, it’s not even close. Utilities are down 10% so far this year, trailing the index by nearly 30%, the 2nd largest calendar year gap in at least 35 years. Asset managers are grossly underallocated to this sector and only hammers home my point that investors are unprepared for what might happen soon.

Long bonds are facing a similar path. Over the past year, long-term Treasuries are underperforming junk bonds by more than 18%. If you look historically, the 20-25% range on the trailing 1-year performance gap is around the area where sharp reversals tend to occur. We saw it in 2009 (in an extreme example where the gaps got much wider). We saw it again in 2011, 2013, 2017 and 2021. At each of those peaks, what followed was a roughly 1-2 year cycle where returns flipped and Treasuries significantly outperformed low quality debt (a similar result occurs with utilities, but with less consistency). The point is that huge performance gaps between risk-on/risk-off asset pairs tend to get sharply reversed and we’re at or near those levels again.

If you want to take a look at another data point, the VIX provides a good example. It’s in the 13s again, a level last reached just prior to the COVID bear market. In fact, the VIX has a long history of dipping down into that abnormally low 10-15 range prior to spiking higher suddenly. It also happened prior to the financial crisis, the 2015 junk bond crisis, Volmaggedon in 2018 and the 2018 mini-bear market.

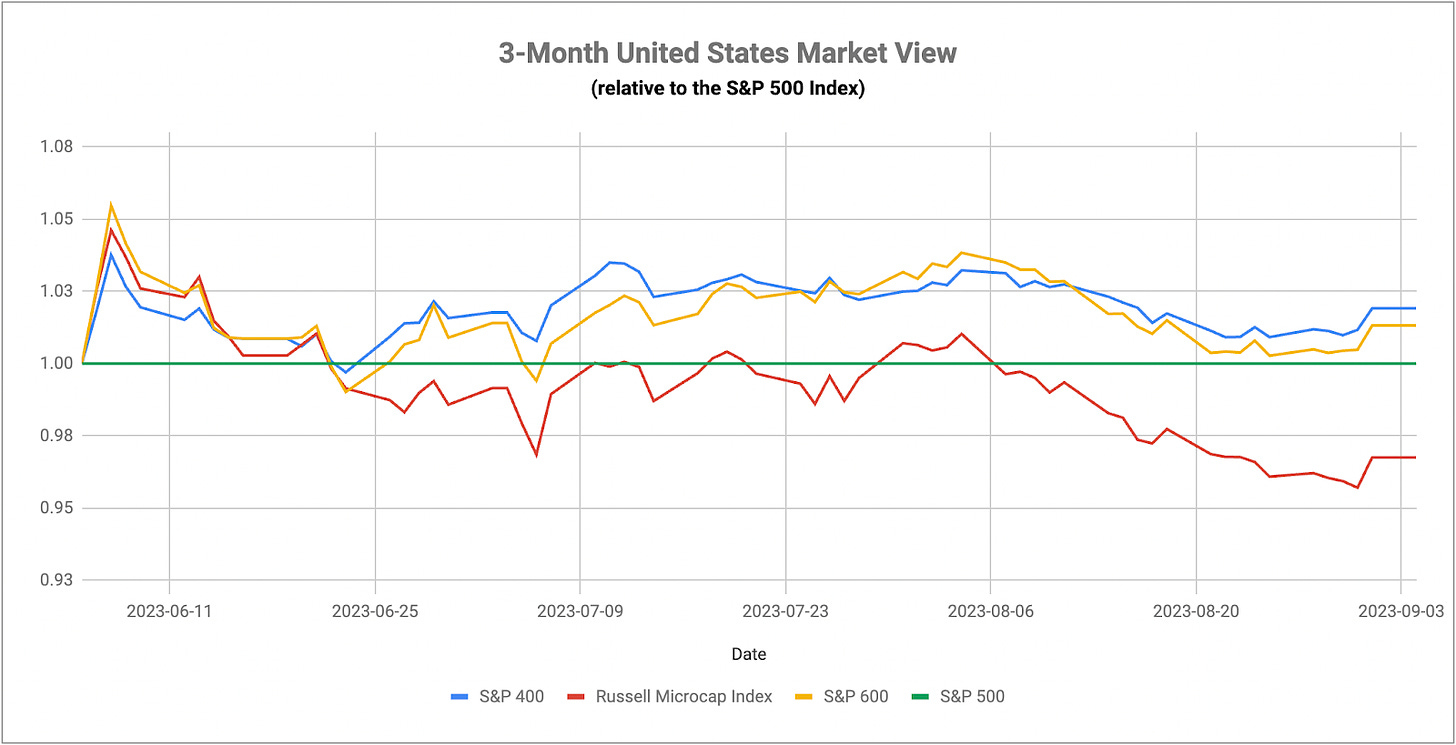

While you’ll hear a lot about soft landings, no landings, new bull markets or avoiding a recession, the numbers and history suggest we might be on the precipice of a major risk-off move. Investors have gotten very juiced up by recent data showing the economy is healthy and the Fed could be done hiking. That might result in short-term Goldilocks conditions, but they’re looking increasingly unsustainable. Treasuries are volatile. Small-caps are becoming more volatile. Greed is still pervasive and investors aren’t considering even basic risk management set-ups. As I noted online, the risks are continuing to build and the credit event looks like it’s getting closer.

Keep reading with a 7-day free trial

Subscribe to The Lead-Lag Report to keep reading this post and get 7 days of free access to the full post archives.