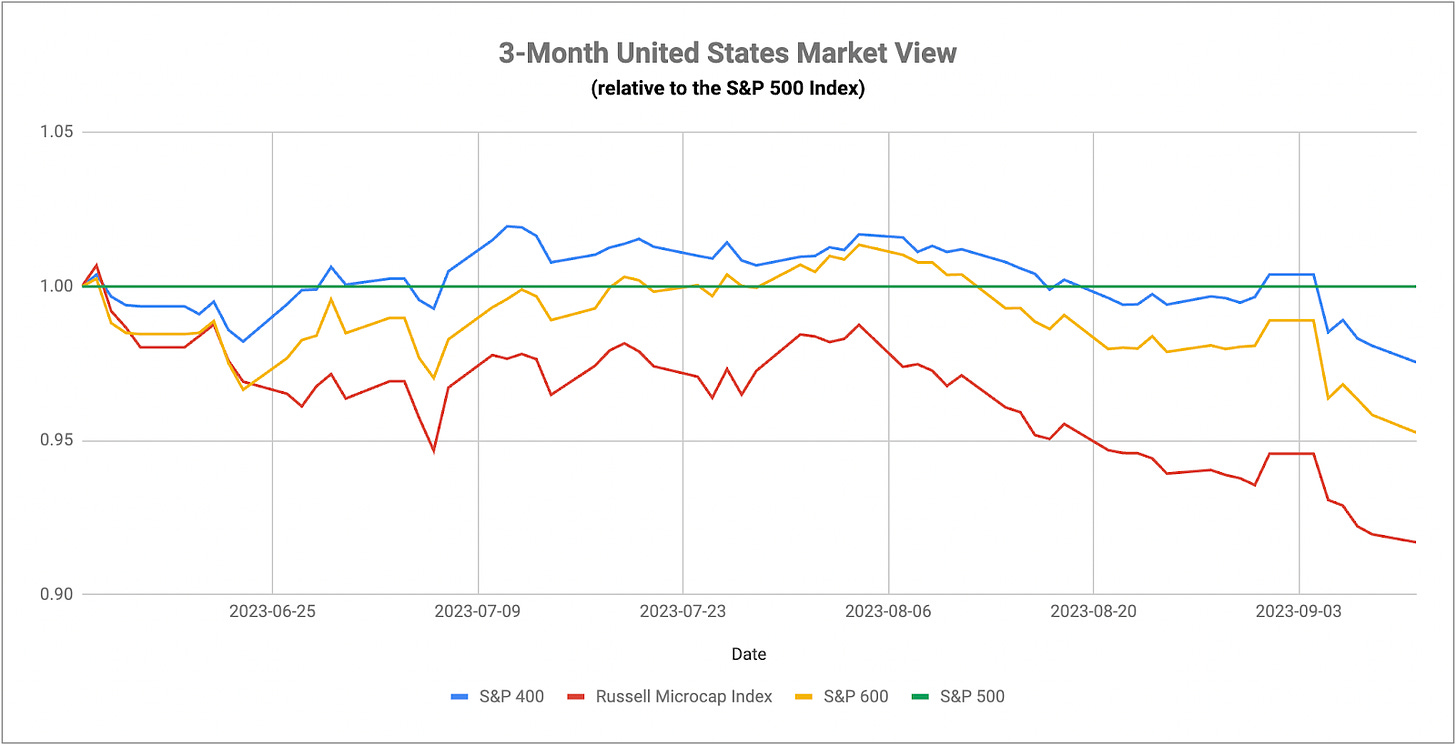

Over the past month, investors have returned to what’s worked best this year - mega-caps and tech. Over this time frame, the S&P 500 is up narrowly, but the Nasdaq 100 has gained about 3%, giving the impression that the equity markets are still in relatively good shape. In reality, intermarket behaviors are strongly suggesting that the opposite is taking place. We can see pretty clearly from the chart above that mid- and small-caps have lagged their large-cap counterparts pretty badly since the beginning of August. Outside of energy stocks, cyclicals and transports have turned sharply lower. Even the advance-decline line on the Nasdaq is trending lower, not higher, throughout all of this. Utilities have picked up strength again for the past week and a half and are making another run at leading the U.S. market. This looks very similar to what we saw in the initial aftermath of the AI boom where the markets were led by just a handful of stocks at the expense of everything else. Narrowly-led markets, like the one we’re in now, tend to break down eventually and we could be starting to see that happen again.

This week’s August CPI release is likely to shape the direction of both the markets and the Fed over the next couple weeks. Before, headline inflation was coming down, but it was the stickiness of core inflation that was the big concern. Now, it’s the opposite - core inflation is cooling, but headline inflation is picking up thanks to the rally in crude oil and other energy prices. The geopolitical backdrop for the oil market looks negative for both the economy and consumers, so it’s reasonable to expect that energy inflation will be a problem at least through the end of 2023. Saudi Arabia, in particular, continues to play with production levels in order to keep prices elevated and that may prevent the Fed from getting fully onboard with a policy pause and, by extension, Treasury yields moving substantially lower. Most of the Fed members have gone on record stating that while policy conditions look more balanced today, the fight against inflation is far from over. Powell likes to keep his tone hawkish in situations like this and I suspect that’s what we’ll hear again next week after the central bank’s meeting.

This week, however, could be similarly consequential. On Thursday, we’ll get the regular weekly jobless claim number as well as the August retail sales report. Jobless claims are one number that the market is watching closely for signs of growing weakness in the labor market, but so far it’s been giving no such signal. Jobless claims have actually continued trending lower since the end of July and remain the one data point that has yet to crack. This, of course, is only one piece of the overall labor market picture. Other numbers, including job openings and job cuts, have been indicating that the jobs market is actually cooling, but the consensus that the labor market has begun to break remains elusive.

Retail sales in recent months have been able to remain relatively sturdy despite indications that consumers are running out of cash and they’re getting buried under a mountain of debt. It seems pretty clear at this point that people are spending with their credit cards, not cash, and that’s a factor that will almost certainly help usher in a credit event. Sales are expected to tick higher again, but both quantitative and qualitative data elsewhere suggests the consumer is no longer operating from a position of strength. The resumption of student loan payments is another thing that’s going to continue sapping consumers’ purchasing power.

Keep reading with a 7-day free trial

Subscribe to The Lead-Lag Report to keep reading this post and get 7 days of free access to the full post archives.